|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Interest rates. The Fed does not need slinky women in plunging necklines

to peddle money. All it needs is low interest rates. When rates are pushed

lower than the rate of inflation, the Fed provides a subsidy for borrowing.

This is not as hard to grasp as it sounds. If I offered to give you $1.00

for very 90 cents you gave me in return, you would buy as many dollars

from me as you could. The Fed operates the same way. It generates market

activity by creating incentives for borrowing. Borrowing leads to

speculation, and speculation leads to steadily rising asset prices. This

is how the game is played. The Fed is not an unbiased observer of free

market activity. The Fed drives the market. It fuels speculation and

controls behavior by fixing interest rates....Read

Article

“A year ago,” said law professor Ross Buckley on Australia’s ABC News on September 22, “nobody wanted to know the International Monetary Fund. Now it’s the organiser for the international stimulus package which has been sold as a stimulus package for poor countries.”

The IMF may have catapulted to a more exalted status than that. According to Jim Rickards, director of market intelligence for scientific consulting firm Omnis, the unannounced purpose of the G20 Summit in Pittsburgh on September 24 was that “the IMF is being anointed as the global central bank.” Rickards said in a CNBC interview on September 25 that the plan is for the IMF to issue a global reserve currency that can replace the dollar.

“They’ve issued debt for the first time in history,”

said Rickards. “They’re issuing SDRs. The last SDRs came out around 1980

or ’81, $30 billion. Now they’re issuing $300 billion. When I say issuing,

it’s printing money; there’s nothing behind these SDRs.”...........more

5 Ways the Government Used Our Money to Save Big Banks and Screw Us The government hasn't exactly been forthcoming about how it has made

buckets of money available to the banking sector. But here's what really

happened........more

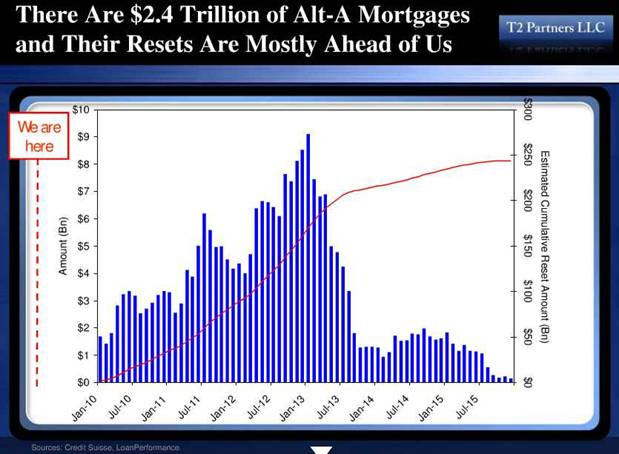

In December 14, 2008, in his interview on the CBS sixty minutes show,

Whitney Tilson an investment fund manager predicted that the subprime

collapse was only half way of the total real estate bubble, and that the

second half will begin take place around 2010 and will continue until

about the year 2013. Tilson also discussed the two fancy Wall Street terms

for bad mortgages namely Alt-A (Alternative-A paper) and option arms

mortgages. These loans lured borrowers with teaser rates that will begin

to reset this year........more

Global Research, July 20,

2009

With a view to restoring financial stability, World

leaders have called upon the Group of 20 countries (G-20) to instigate a

new global currency based on the IMF's Special Drawing Rights (SDRs).

Russia and China have put forth "proposals" which have

been highlighted as possible alternatives to the dollar. China has

proposed the formation of a new global currency based on a reform of SDR

system:.......more

The Secrets of China's Economy: The

Government Owns the Banks rather than the Reverse

by Ellen Brown

While the U.S. spends trillions of dollars to bail out its banking system, leaving its economy to languish, China is being called a “miracle economy” that has decoupled from the rest of the world. As the rest of the world sinks into the worst recession since the 1930s, China has maintained a phenomenal 8% annual growth rate. Those are the reports, but commentators are dubious. They ask how that growth is possible, when other countries relying heavily on exports have suffered major downturns and remain in the doldrums. Economist Richard Wolff skeptically observes: We now

have a situation in the world where we have a global capitalist crisis.

Everywhere, consumption is down. Everywhere, people are buying fewer

goods, including goods from China. How is it possible that in that

society, so dependent on the world economy, they could now have an

explosive growth? Their stock market is now 100 percent higher than at its

low -- nothing remotely like that hardly anywhere in the world, certainly

not in the United States or Europe. How is that possible? In order to

believe what the Chinese are saying, you would have to agree that in a

matter of months, at most a year, no more, they have been able to

transform their economy from an export-based powerhouse to a domestically

focused industrial engine. Nowhere in the world has that ever taken less

than decades.”........more

Published on Monday, July 27, 2009 by

CommonDreams.org

Profiling CEOs and Their Sociopathic Paychecks

The Wall Street Journal reported last week that "Executives and other

highly compensated employees now receive more than one-third of all pay

in the US... Highly paid employees received nearly $2.1 trillion

of the $6.4 trillion in total US pay in 2007, the latest figures

available."

One of the questions often asked when the subject of CEO pay comes up

is, "What could a person such as William McGuire or Lee Raymond (the

former CEOs of UnitedHealth and ExxonMobil, respectively) possibly do to

justify a $1.7 billion paycheck or a $400 million retirement

bonus?"........more |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

ACTION ALERT: DEMAND A SAY IN NORTH AMERICA'S FUTURE The next North American leaders summit

- where Canada, the United States and Mexico have met to discuss progress

on the Security and Prosperity Partnership is less than four weeks away

and Canadians have been told nothing about it.........more

Instead of Real Financial Reform, Obama’s

Plan capitulates to Wall Street

by Prof. Michael Hudson

Writes Bob Chapman of International Forecaster:

Wall Street Ends Hope for Homeowners Via

Congress

by Shamus Cooke

As if the bank bailouts weren’t proof enough that Wall Street owned Congress. History will likely show that these bailouts involved the largest transfer of wealth ever — from the working class to that small group of billionaires who own the corporations. This fact is recognized by most people now and is such common knowledge that even the mainstream media feels comfortable discussing it…matter-of-factly.

These corporations have also exerted tremendous

influence in other realms of politics, working towards destroying Obama’s

campgain promises of health care, job creation, civil liberties, the

Employee Free Choice Act, peace, etc.........

more

Manipulation: How Financial Markets

Really Work

by Stephen Lendman

Wall Street's mantra is that markets move randomly and reflect the collective wisdom of investors. The truth is quite opposite. The government's visible hand and insiders control markets and manipulate them up or down for profit - all of them, including stocks, bonds, commodities and currencies. It's financial fraud or what former high-level Wall

Street insider and former Assistant HUD Secretary Catherine Austin Fitts

calls "pump and dump," defined as "artificially inflating the price of a

stock or other security through promotion, in order to sell at the

inflated price," then profit more on the downside by short-selling. "This

practice is illegal under securities law, yet it is particularly common,"

and in today's volatile markets likely ongoing daily. ....more

Published on Tuesday, May 26, 2009 by

TomDispatch.com

The Financial Bailout: The Greatest Swindle Ever SoldHow It Scams Taxpayers, Subsidizes Wall Street, and Props Up Our Broken Financial System

On October 3rd, as the spreading economic meltdown threatened to topple

financial behemoths like American International Group (AIG) and Bank of

America and plunged global markets into freefall, the U.S. government

responded with the

largest bailout in American history. The Emergency Economic

Stabilization Act of 2008, better known as the Troubled Asset Relief

Program (TARP), authorized the use of $700 billion to stabilize the

nation's failing financial systems and restore the flow of credit in the

economy. ....more

Have Geithner's Zombie Ideas Won? Paul Krugman on the "Cash for Trash" Program

Amy Goodman: Treasury Secretary Timothy Geithner has unveiled

the Obama administration’s plan to finance the purchase of up to $1

trillion in so-called toxic assets from banks and other ailing financial

institutions. The plan relies on private investors, namely hedge funds and

private equity firms, to team up with the government to relieve banks of

assets tied to loans and mortgage-linked securities. There have been

virtually no buyers of these assets thus far because of their uncertain

risk. As part of the program, the government plans to offer subsidies in

the form of low-interest loans to coax private funds to form partnerships

with the government to buy troubled assets from banks. This is intended to

unclog the balance sheets of banks and allow them to resume normal

lending......more

Bailed Out JPMorgan to Blow Millions on Luxury Jets, Aircraft Hangar Number of the day: 138. The number, in millions, JPMorgan Chase, which has received $25 billion in bail-out funding, plans to spend "to buy two new luxury corporate jets and build 'the premiere corporate aircraft hangar on the eastern seaboard' to house them, ABC News has learned."

"Getting Tough" with Predator Financial

Institutions"

AIG, Larry Summers and the Politics of

Deflection

by F. William Engdahl

Finally the US authorities have gotten ‘tough’

with the predator financial institutions. The world has been waiting for

such decisive intervention since an unending series of Government bailouts

of financial institutions began early in 2008 amounting to now trillions

of taxpayer dollars. Now, with the world’s largest insurance giant, AIG,

the White House Economic Council chairman, Larry Summers has expressed

‘outrage.’ President Obama himself has entered the fray to promise

‘justice.’ US Senators have threatened a law to change the injustice. The

only problem is they are all exercising ‘politics of deflection,’ taking

attention away from the real problem, the fraudulent bailout. ......more

The Financial Crisis Pushes Europe to the Brink of Disaster KREMS, Austria -- Obsessed as we are about our own

crumbling economy, it's hard for most Americans to see and appreciate the

global nature of the crisis and how it is impacting, and will impact,

others throughout the world. We don't recognize how many in other

countries blame the fall of their own economies on a kind of "financial

AIDS" born in the USA......more

Civil Unrest in America?

by José Miguel Alonso Trabanco

Eurasia is currently experiencing serious problems derived from financial and economic difficulties such as unemployment, GDP negative growth, currency depreciation, overall economic slowdown and so on. Several members of both the European Union and NATO (Poland, Hungary, Iceland come to mind) are already dealing with a considerable deal of domestic discontent. Some States from the Former Soviet Union (notably Ukraine, Belarus and the Central Asian Republics) and even Russia itself are facing similar problems. Even Chinese government officials acknowledge protests in the Chinese mainland, as pointed out by Professor Michael Klare, which means that East Asia is by no means an exception. As we shall see, financial and economic conditions are equally grave in the American hemisphere, if not more so.

Zbigniew Brzezinski,

former National Security Advisor and early supporter of Barack Obama's

presidential campaign, has warned that civil unrest on American soil is a

possibility that should not be dismissed. Brzezinski explains that "[the

United States is] going to have millions and millions of unemployed,

people really facing dire straits. And we’re going to be having that for

some period of time before things hopefully improve. And at the same time

there is public awareness of this extraordinary wealth that was

transferred to a few individuals at levels without historical precedent in

America..." Brzezinski concludes with this noteworthy remark "...hell,

there could be even riots". .........more

"Strong economic medicine"

with a "human face" At first sight, the budget

proposal has all the appearances of an expansionary program, a demand

oriented "Second New Deal" geared towards creating employment, rebuilding

shattered social programs and reviving the real economy..........more

The Spectacular, Sudden Crash of the Global Economy The worldwide economic meltdown has sent the wheels spinning off the project of building a single, business-friendly global economy. Worldwide, industrial production has

ground to a halt. Goods are stacking up, but nobody's buying; the

Washington Post

reports that "the world is suddenly awash in almost everything:

flat-panel televisions, bulldozers, Barbie dolls, strip malls, Burberry

stores." A Hong Kong-based shipping broker told

The Telegraph that his firm had "seen trade activity fall off a

cliff. Asia-Europe is an unmitigated disaster." The Economist

noted that one can now ship a container from China to Europe for free

-- you only need to pick up the fuel and handling costs -- but half-empty

freighters are the norm along the world's busiest shipping routes.

Global airfreight dropped by almost a quarter in December alone;

Giovanni Bisignani, who heads a shipping industry trade group, called the

"free fall" in global cargo "unprecedented and shocking."......more

European banks face an entirely new wave of losses in coming months not yet calculated in any government bank rescue aid to date. Unlike the losses of US banks which derive initially from their exposures to low-quality sub-prime real estate and other securitized lending, the problems of western European banks, most especially in Austria, Sweden and perhaps Switzerland arise from the massive volumes of loans they made during the 2002-2007 period of extreme low international interest rates to clients in eastern European countries. The problems in Eastern Europe

which are just now emerging with full force are, if you will, an

indirect consequence of the libertine monetary policies of the Greenspan

Fed from 2002 until 2006, the period where Wall Street’s asset backed

securitization Ponzi Scheme took off.........more

U.S. Intel Chief's Shocking Warning: Wall Street's Disaster Has Spawned Our Greatest Terrorist Threat We have a remarkable ability to create our own monsters. A few decades

of meddling in the Middle East with our Israeli doppelgnger and we get

Hezbollah, Hamas, al-Qaida, the Iraqi resistance movement and a resurgent

Taliban. Now we trash the world economy and destroy the ecosystem and sit

back to watch our handiwork. Hints of our brave new world seeped out

Thursday when Washington's new director of national intelligence, retired

Adm. Dennis Blair, testified before the Senate Intelligence Committee. He

warned that the deepening economic crisis posed perhaps our gravest threat

to stability and national security. It could trigger, he said, a return to

the "violent extremism" of the 1920s and 1930s..........more

How Wall Street's Scam Artists Turned Home Mortgages Into Economic WMD Conservative pundits and politicians have piled onto the excuse like

shipwreck victims clinging to a passing log: The real blame for the

current economic crisis, conservatives would have you believe, lies not

with anything they did, but rather with the 1977 Community Reinvestment

Act -- a successful Carter-era program designed to get banks to stop

covert discrimination, and encourage them to invest their money in

low-income neighborhoods.........more

Nationalizing the Banks Seems Inevitable: How Bad Does It Have to Get First? There is a bottom-line to the banking crisis which the Obama

administration appears intent on trying to avoid: some number of financial

giants are simply insolvent. A recent

analysis by NYU economist Nouriel Roubini -- known as "Doctor Doom"

for his dire predictions about the collapse of the financial trading

system, predictions that have since become painfully true -- estimated

that the losses facing the American financial sector will reach $3.6

trillion dollars...more

After

The Financial Crisis Is Driving Hordes of Americans to Suicide Pushed past their breaking points, people are robbing banks to pay the rent, setting homes on fire -- even taking their own lives. The body count is still rising. For months on end, marked by

bankruptcies, foreclosures, evictions, and layoffs, the economic meltdown

has taken a heavy toll on Americans. In response, a range of extreme acts

including suicide, self-inflicted injury, murder, and arson have hit the

local news. By October 2008, an

analysis

of press reports nationwide indicated that an epidemic of tragedies

spurred by the financial crisis had already spread from Pasadena,

California, to Taunton, Massachusetts, from Roseville, Minnesota, to

Ocala, Florida.....more

The Conservative government has leaked the details of Tuesday's budget. They have announced a $64 billion deficit. The Harper government, which has consistently committed itself to a "balanced budget", now claims that deficit spending is required to boost the economy at the height of a major economic recession. Does this constitute a turnaround in federal government economic policy? Is the government really committed to running a budget deficit with a view to stimulating demand and reversing the tide of economic decline. Or is there a hidden agenda?......more

Across the land, an atmosphere of hope and optimism prevails. The Bush regime has gone. A new president is in the White House. While America had its eyes riveted on the live TV

broadcast of Barack Obama's presidential inauguration, financial

markets were sliding. Immediately following the inauguration, the Dow Jones plummeted, largely affecting the share prices of major financial institutions. The quoted stock values of major Wall Street banks

plummeted. Citigroup

fell by 20 percent,

Bank of America by 29 percent and JP Morgan Chase by 20 percent.

The Royal Bank of Scotland fell by 69 percent in

New York trading.........more

How to Resolve the Credit Crisis:

Credit Where Credit is Due

by Ellen Brown

Economist John Kenneth Galbraith famously said, “The process by which banks create money is so simple that the mind is repelled.” If banks can create money, why are we suffering from a “credit crunch”? Why can’t banks create all the money they can find borrowers for? Last fall, Congress committed an unprecedented $700 billion in taxpayer money to reversing the credit crisis, and the Federal Reserve has already fanned that into $8.5 trillion in loans and commitments.1 But the bank bailout has proven to be no more than a boondoggle for a handful of lucky Wall Street banks, without getting credit flowing again.

To understand the real cause of the credit crisis and

how it can be reversed, we first need to understand credit itself – what

it is, where it comes from, and what the real tourniquet is that has

limited its flow. Banks actually create credit; and if

private banks can do it, so could public banks or public treasuries.

The crisis is not one of “liquidity” but of “solvency.” It has been

caused, not by the banks’ inability to get credit (something they can

create with accounting entries), but by their inability to meet the

capital requirement imposed by the Bank for International Settlements, the

private foreign head of the international banking system. That

inability, in turn, has been caused by the derivatives virus; and only a

few big banks are seriously infected with it. By bailing out these

big banks, the government is actually spreading the virus by furnishing

the funds for them to take over smaller regional banks.........more

Martial Law, the Financial Bailout, and

War

by Prof. Peter Dale Scott

Global Research, January 8,

2009

Paulson’s Financial Bailout

It is becoming clear that the bailout measures of late 2008 may have consequences at least as grave for an open society as the response to 9/11 in 2001. Many members of Congress felt coerced into voting against their inclinations, and the normal procedures for orderly consideration of a bill were dispensed with.

The excuse for bypassing normal

legislative procedures was the existence of an emergency. But one of the

most reprehensible features of the legislation, that it allowed Treasury

Secretary Henry Paulson to permit bailed-out institutions to use public

money for exorbitant salaries and bonuses, was inserted by Paulson after

the immediate crisis had passed......more

Union Ramps Up Massive Campaign to Keep Obama's Feet to the Fire The SEIU says it's making a big push and committing huge resources to word for the passage of key progressive measures to aid working families. This week, SEIU, one of the most aggressive -- and progressive -- labor

unions in the country, announced the launch of what Anna Burger, the

organization's international treasurer-secretary, promised to be "the

greatest grassroots accountability campaign that had ever been seen in

America." In a press call, Burger promised that the organization would

invest a massive 30 percent of its annual budget for the "Change That

Works" campaign, money she said would be used to "[make] sure that elected

officials live up to their promises to working

families.".....................more

This Looks Like the Start of a Second Great Depression Will we act swiftly and boldly enough to stop it from happening? “If we don’t act swiftly and boldly,” declared President-elect Barack Obama in his latest weekly address, “we could see a much deeper economic downturn that could lead to double-digit unemployment.” If you ask me, he was understating the case. The fact is that recent economic numbers have been terrifying, not just

in the United States but around the world. Manufacturing, in particular,

is plunging everywhere. Banks aren’t lending; businesses and consumers

aren’t spending. Let’s not mince words: This looks an awful lot like the

beginning of a second Great Depression................more

Why Big Finance Is Laughing All the Way to the Bank Instead of making loans to help the economy, they're shoring up their own finances and buying up their competitors. The country's financial markets have collapsed, as they tend to do when left without adult supervision, and they're taking our economy with them. With the large banks refusing to make loans after losing billions on worthless subprime derivatives, the government stepped in and agreed to October's financial bailout package. The $700 billion legislation was meant to buy banks' "troubled assets"

for cash, and thus improve banks' balance sheets to the point that they

would lend again. This would mean credit for struggling businesses and

households and could encourage expansion and hiring, thus pulling us out

of recession............more

The Crisis of Common Sense: Is It So

Difficult To Understand The Financial Crisis?

by Matthias Chang

Thinking & Common Sense When we think naturally and use common sense to address problems we will be able to arrive at simple solutions. But our education system tortures us mentally and forces us to think in complicated ways. Our teachers, economists, politicians and so-called experts in God and religion make mountains out of mole-hills, turning simple truths to complex arguments and “scientific theories and equations”. These experts need to make things look difficult to survive and to make sure that we have to rely upon them for solutions. It is often said that, “in the land of the blind, the man with one eye is the King”. Thinking used to be a pleasure and so very invigorating. But now experts have ensured that thinking is difficult and tiring, so burdensome, that we don’t think at all. The result is that common sense is thrown out of the

window, and we have been conditioned to rely on our mental crutch, the

so-called experts to think for us.............more

Busting Paranoid Right-Wing Fantasies of Dissolving the Mexico-U.S.-Canada Borders It's time to call BS on the idea of a mythical North American Union. This month, President Bush will host the leaders of Canada and Mexico to advance the Security and Prosperity Partnership (SPP), a project Lou Dobbs has predicted will "end the United States as we know it." Lou sounds downright blasé, though, compared to all the online ranting

and raving on this subject. And while there are plenty of reasons for

progressives to be up in arms over this effort to expand the North

American Free Trade Agreement, the xenophobes have clearly cornered the

market.....more

Was the 'Credit Crunch' a Myth Used to Sell a Trillion-Dollar Scam? Even as the media continue to repeat the claim that credit has frozen up, evidence has emerged suggesting the entire story is wrong.There is something approaching a consensus that the Paulson Plan -- also known as the Troubled Asset Relief Program, or TARP -- was a boondoggle of an intervention that's flailed from one approach to the next, with little oversight and less effect on the financial meltdown. But perhaps even more troubling than the ad hoc nature of its

implementation is the suspicion that has recently emerged that TARP --

hundreds of billions of dollars worth so far -- was sold to Congress and

the public based on a Big Lie............more

Let the Banks Fail: Why a Few of the Financial Giants Should Crash The finance industry still owns mountains of bad paper and must absorb these losses -- or else we'll face a very long recession. So far, much of Washington’s ad hoc, ham-fisted response to the economic crisis has been based on the dictum that the financial institutions must be prevented from taking their losses. That should come as no surprise. Big finance’s

lobbyists have been all over the "bailout" (it should be bailouts,

plural) from the very start, Wall Street pumped piles of cash into the

elections — AIG, recipient of tens of billions in taxpayer largesse,

ponied up $750,000 for both the Democratic and Republican conventions —

and the whole thing’s

been designed by "free-market" ideologues who came to Washington

directly from Wall Street..........more |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Collapse of Pension Funds: The End of

Retirement?

|

|

| by Shamus Cooke | |

|

Global Research, December 13,

2008

|

|

Unless things change fast, human

history will show that the phenomenon of “retirement” was limited to one

generation. After World War II, when European and Japanese economies stood

in tatters, American capitalism could fulfill “the American dream,” since

there was little foreign competition to speak of. For the first time

ever, workers were promised that — after working thirty or so years — they

would be able to securely retire. That was largely the case…for one

generation...........more![]()

![]()

|

Global Research, December 15,

2008

|

The Federal Reserve has bluntly refused a request by a major US financial news service to disclose the recipients of more than $2 trillion of emergency loans from US taxpayers and to reveal the assets the central bank is accepting as collateral. Their lawyers resorted to the bizarre argument that they did so to protect 'trade secrets.' Is the secret that the US financial system is de facto bankrupt? The latest Fed move is further indication of the degree of panic and lack of clear strategy within the highest ranks of the US financial institutions. Unprecedented Federal Reserve expansion of the Monetary Base in recent weeks sets the stage for a future Weimar-style hyperinflation perhaps before 2010.

On November 7 Bloomberg filed suit under the US Freedom of

Information Act (FOIA) requesting details about the terms of eleven new

Federal Reserve lending programs created during the deepening financial

crisis......more![]() .

.

![]()

Let's Cut Out the Banks and Finance American Innovation

Then the U.S. government can be an investor instead of a reluctant donor.

Just this morning, I heard that my favorite union printing press had closed

its doors. Last night, I heard that Olsson's, the great book/music place in

Washington, D.C., closed all five of its stores last month. There are times

when I work at my Vox Pop café in Manhattan and wait one hour for a single

customer to walk in. Consumer spending is going steadily down. Unemployment is

around 6.5 percent, and that's just the "official" rate...........more![]()

![]()

Even though the Federal Reserve is now

the biggest single participant in the financial system, the myth of a "free

market" still lingers on. It's mind boggling. The Fed has expanded its balance

sheet by $2 trillion, guaranteed $8.3 trillion of dodgy mortgage-backed paper,

provided a backstop for bank deposits, money markets, commercial paper, and

created 8 separate lending facilities to ensure that underwater financial

institutions can still appear to be solvent. The whole system is a state

subsidized operation buoyed on a taxpayer-provided flotation device which

bears no resemblance to an invisible hand. More astonishing, is the massive

power grab engineered by the Fed which has taken place without the slightest

protest from 535 shell-shocked congressmen and senators......more![]()

![]()

While Some of Us Are Hoping for Change, Others Are Literally Starving for It

The swelling numbers waiting outside homeless shelters and food pantries around the country have grown by at least 30 percent since the summer.

Elba Figueroa worked as a nurse’s aide until she got Parkinson’s disease.

She lost her job. She lost her health care. She receives $703 a month in

government assistance. Her rent alone costs $750. And so she borrows money

from friends and neighbors every month to stay in her apartment. She

laboriously negotiates her wheelchair up and down steps and along the frigid

sidewalks of Trenton, N.J., to get to soup kitchens and food pantries to eat...........more![]()

![]()

This

Is Not A Normal Recession: Moving on to Plan

This

Is Not A Normal Recession: Moving on to Plan

|

Global Research, November 21,

2008

|

|

"The Winter of 2008-2009 will prove to be the

winter of global economic discontent that marks the rejection of the flawed

ideology that unregulated global financial markets promote financial

innovation, market efficiency, unhampered growth and endless prosperity while

mitigating risk by spreading it system wide." Economists Paul Davidson

and Henry C.K. Liu "Open Letter to World Leaders attending the November 15

White House Summit on Financial Markets and the World Economy"

The global economy is being sucked into a black hole and most Americans have

no idea why. The whole problem can be narrowed down to two words; "structured

finance"............more![]()

![]()

How the Rich Are Destroying the Earth

There is an emergency. In less than a decade we will have to change

course, but there are a few major obstacles blocking the way.

The following is reprinted from the new book How the Rich Are Destroying the Earth by Herve Kempf and published by Chelsea Green.

There is an emergency. In less than a decade we will have to change course -- assuming the collapse of the U.S. economy or the explosion of the Middle East does not impose a change through chaos. To confront the emergency, we must understand the objective: to achieve a sober society; to plot out the way there; to accomplish this transformation equitably, by first making those with the most carry the burden within and between societies; to take inspiration from collective values ascribed to here in France by our nation's motto: "Liberty, ecology, fraternity."

What are the main obstacles that block the way?...........more![]()

![]()

![]() Wall Street's Bailout is a Trillion-Dollar

Crime Scene -- Why Aren't the Dems Doing Something About It?

Wall Street's Bailout is a Trillion-Dollar

Crime Scene -- Why Aren't the Dems Doing Something About It?

Washington's handling of the bailout is not merely incompetent. It may well be illegal.

The more details emerge, the clearer it becomes that Washington's handling of the Wall Street bailout is not merely incompetent. It is borderline criminal.

In a moment of high panic in late September, the U.S. Treasury unilaterally

pushed through a radical change in how bank mergers are taxed -- a change long

sought by the industry. Despite the fact that this move will deprive the

government of as much as $140 billion in tax revenue, lawmakers found out only

after the fact. According to the Washington Post, more than a dozen tax

attorneys agree that "Treasury had no authority to issue the [tax change]

notice."..............more![]()

![]()

On October 28, the Financial Times' columnist Martin Wolf wrote:

"Preventing a global slump must be the priority." He cited Nouriel Roubini

back in February listing "twelve steps to financial disaster," all of which

the US took and dragged the whole world down with it......

more![]()

![]()

![]() College Loan Slavery: Student Debt Is

Getting Way Out of Hand

College Loan Slavery: Student Debt Is

Getting Way Out of Hand

The quest for a college degree is dumping millions of young people deep into a pit of debt from which many will never recover.

Raya Golden thought she was handling college in a responsible way. She

didn't apply until she felt ready to dedicate herself to her studies. She

spread her schooling across five years so she could work part-time throughout.

She checked that her school, the Academy of Art University in San Francisco,

had a high post-graduate employment rate. But there were two things she hadn't

counted on. The first was the $75,000 in nonsubsidized federal student loans

she'd have to take out for tuition and those living expenses her part-time

jobs selling hotdogs and making lattes couldn't cover. The second was that

she'd graduate into a workforce teetering on the edge of the biggest financial

crisis since the Great Depression.......more![]()

![]()

![]() Why Won't the Federal Reserve Say Who

They Gave $2 Trillion To?

Why Won't the Federal Reserve Say Who

They Gave $2 Trillion To?

The Federal Reserve is refusing to identify the recipients of almost $2 trillion of emergency loans.

Apparently Bernanke, that wonderful bipartisan soul who is so competent and

wonderful that everyone in the village thinks Obama should leave him in charge

is refusing to identify who got almost 2 trillion dollars of Fed cash.

Bloomberg News is suing to find out. Personally I really, really, really want

to know. What exactly is Bernanke hiding? Who got the money he doesn't want us

to know got the money?......more![]()

![]()

![]() The

Five Most Wanted Rip-off Artists from Wall Street and Washington

The

Five Most Wanted Rip-off Artists from Wall Street and Washington

Our economy didn't melt down, it was taken down the unbridled greed of economic elites, enabled by their political courtesans in Washington.

What the hell's happening here? Why is my bank in the tank? And my house and job? And my retirement money? Even my state's teetering on the brink of broke! Who did this to us?

Fair questions, but we're not getting honest answers. Last year, at the first signs of the global financial slide toward the abyss, we were told that it's just a little hiccup caused by something called subprime mortgages. Not to worry, the Powers That Be declared confidently, for we have the damage contained. And rest assured that "the fundamentals of our economy are sound."

![]()

Goldman Sachs ready to hand out £7bn

salary and bonus package... after its £6bn bail-out

Goldman Sachs ready to hand out £7bn

salary and bonus package... after its £6bn bail-out

By

Simon Duke

Last updated at 8:55 AM on 30th October 2008

Goldman Sachs is on course to pay its top City bankers multimillion-pound bonuses - despite asking the U.S. government for an emergency bail-out.

The struggling Wall Street bank has set aside £7billion for salaries and 2008 year-end bonuses, it emerged yesterday.

Each of the firm's 443 partners is on course to pocket an average Christmas bonus of more than £3million.

The size of the pay pool comfortably dwarfs the £6.1billion lifeline which the U.S. government is throwing to Goldman as part of its £430billion bail-out.

As Washington pours money into the bank, the cash will immediately be channelled to Goldman's already well-heeled employees.

News of the firm's largesse will revive the anger over the 'rewards for failure' culture endemic in the world of high finance.

The same bankers who have brought the global economy to its knees seem to

pocketing the same kind of rewards they got during the boom years.......more![]()

![]()

FOR IMMEDIATE RELEASE

October 8, 2008

Economists' Open Letter Calls For Active Response to Economic Crisis

http://www.progressive-economics.ca/2008/10/07/open-letter/Ottawa: Today, 85 economists released

an Open Letter criticizing the federal government for its inaction in light of

the deepening global financial crisis, the growing probability of a worldwide

recession, and structural weaknesses in the Canadian economy. The letter

challenges government claims that Canada¹s ³fundamentals² are strong, and

highlights the significant deterioration in Canada¹s economic performance over

the last two years. Despite recent government statements, there remains a wide

disconnect between the appropriate policy response to the looming downturn,

and the ³stay-the-course² approach still being enunciated by the Prime

Minister..........more![]()

![]()

|

|

SAVING THE UNHOLY BANK MESS WITH SIMPLE ACCOUNTANCY |

| by William Krehm | |

| October 31,2008 | |

T

he Governor of the Bank of England, Melvyn King, recently cited the worst bank crisis since World War I as reason for cutting interest rates.That, however, would cause price index to move upward. And in the vocabulary of those who run our economy, that is “inflation” - the worst thing that can happen. The main purpose of banks for the last half-century is to keep prices flat In the real world, the price level can, indeed, more upward because there is too much demand and not enough supply to satisfy it. That is real “ inflation”. But that does not mean that prices may have moved upward for quite other reasons. Nobody who moves from a town of 20 thousand to New York City is foolish enough to believe that his living costs will stay the same. How then can it stay the same when a growing portion of the world’s population has been making just such a move? The number of cities of 5 million has increased on all inhabited continents.

And then there is the detail that the higher

technologies that have taken over call for far more education. that used to be

norm. A century ago anybody who learned to read and write was deemed educated.

Today you need some university education to hold your own against your

computer. One could go on indefinitely enlarging the list of such upward

movements of the price level having nothing to do with an excess of demand

over supply.......more![]()

![]()

![]() Naomi Klein: Bailout = Bush's Final

Pillage

Naomi Klein: Bailout = Bush's Final

Pillage

The bailout has been designed to keep stealing from the Treasury for years to come.

In the final days of the election, many Republicans seem to have given up the fight for power. But that doesn't mean they are relaxing. If you want to see real Republican elbow grease, check out the energy going into chucking great chunks of the $700 billion bailout out the door. At a recent Senate Banking Committee hearing, Republican Senator Bob Corker was fixated on this task, and with a clear deadline in mind: inauguration. "How much of it do you think may be actually spent by January 20 or so?" Corker asked Neel Kashkari, the 35-year-old former banker in charge of the bailout.

When European colonialists realized that they had no choice but to hand

over power to the indigenous citizens, they would often turn their attention

to stripping the local treasury of its gold and grabbing valuable livestock.

If they were really nasty, like the Portuguese in Mozambique in the mid-1970s,

they poured concrete down the elevator shafts........more![]()

![]()

Published on Wednesday, October 29, 2008 by Inter Press Service

Millions Lose Homes, As Families Plead for Help

BOSTON - Bank crashes in Iceland, an International Monetary Fund (IMF) bailout of Ukraine and volatile stock markets the world over -- it all links back to the U.S. communities where hundreds of thousands of families are losing their homes with no let up in sight, those on the frontlines say.

'Foreclosure has been a huge issue, a ballooning, mushrooming issue for at

least two years. We've been inundated with phone calls for help,' said Tracy

Garrett, a housing advocate with Community Action House, a non-profit in

Michigan..........more![]()

![]()

|

They Did It On Purpose: The Housing

Bubble & Its Crash were Engineered by the US Government, the Fed & Wall

Street

|

|

| by Richard C. Cook | |

|

Global Research, October 23,

2008

|

|

During the Clinton administration, the government required the financial industry to start expanding the frequency of mortgage loans to consumers who might not have qualified in the past.

When George W. Bush was named president by the Supreme Court in December 2000, the stock market had begun to decline with the bursting of the dot.com bubble.

In 2001 the frequency of White House visits by Alan Greenspan increased.

Greenspan endorsed President Bush’s March 2001 tax cuts for the rich. More such cuts took place in May 2003.

Signs of recession had begun to show in early 2001. The

stock market crashed after 9/11. The U.S. invaded Afghanistan in October 2001

and Iraq in March 2003......more![]()

![]()

I believe that banking institutions are more dangerous to our liberties than standing armies. (Thomas Jefferson, US President; 1743 - 1826)

America is dying. It is self-destructing and bringing the rest of the world down with it.

Often referred to as a sub-prime mortgage collapse, this obfuscates the real reason. By associating tangible useless failed mortgages, at least something 'real' can be blamed for the carnage. The problem is, this is myth. The magnitude of this fiscal collapse happened because it was all based on hot air.

The banking industry renamed insurance betting guarantees

as 'credit default swaps' and risky gambling wagers were called 'derivatives'.

Financial managers and banking executives were selling the ultimate con to the

entire world, akin to the snake-oil salesmen from the 18th century but this

time in suits and ties. And by October 2009 it was a quadrillion-dollar

(that's $1,000 trillion) industry that few could understand.............more![]()

![]()

![]() How the Banksters Made a Complete

Killing off the Bailout

How the Banksters Made a Complete

Killing off the Bailout

It's going to take about 20 years to repair the damage from the huge rip off created under the guise of "free market" capitalism.

In 1897, when 8-year old Virginia O'Hanlon posed her Santa Claus query to the New York Sun, she received a heart-warming editorial response reassuring her that "He exists as certainly as love and generosity and devotion exist."

Today, we hand our 8 year olds a $13 trillion national debt while our

Congress hands Wall Street banksters the national purse without so much as a

hearing to determine the cause of the debt collapse. Worse still, the money is

doled out to the very same individuals who leveraged their institutions to

casino status................more![]()

![]()

Max Fraad Wolff consulted on and Michelle Fawcett contributed to this article. Illustrations By Frank Reynoso and color by Irina Ivanova. This article relied on many sources, including "The Subprime Debacle" by Karl Beitel, Monthly Review, May 2008. This essay was printed in the Oct. 3, 2008, issue of The Indypendent, and the November 2008 issue of Z Magazine.........more►

![]()

"Despite the bailout, it's clear the economy is going into a deep recession," Robert E. Scott, senior international economist at the Economic Policy Institute, told IPS.

U.S. Federal Reserve Chairman Ben Bernanke warned Tuesday that the U.S. economy is headed downward, hours after The Fed unveiled a programme to buy short-term debt in an effort to stimulate lending among businesses.

The Fed's action followed a drop in the Dow Jones industrial average on Monday to below 10,000 for the first time since 2004, and reports of plunging markets around the world, with markets in Brazil and Russia especially hard hit. Developing nations are bracing for harder times to come. .......more►

![]()

"Some people think that the Federal Reserve Banks are United States Government institutions. They are private monopolies which prey upon the people of these United States for the benefit of themselves and their foreign customers; foreign and domestic speculators and swindlers; and rich and predatory money lenders."

– The Honorable Louis McFadden, Chairman of the House Banking and Currency Committee in the 1930s

The Federal Reserve (or Fed) has assumed sweeping new powers in the last year. In an unprecedented move in March 2008, the New York Fed advanced the funds for JPMorgan Chase Bank to buy investment bank Bear Stearns for pennies on the dollar. The deal was particularly controversial because Jamie Dimon, CEO of JPMorgan, sits on the board of the New York Fed and participated in the secret weekend negotiations.1 In September 2008, the Federal Reserve did something even more unprecedented, when it bought the world’s largest insurance company. The Fed announced on September 16 that it was giving an $85 billion loan to American International Group (AIG) for a nearly 80% stake in the mega-insurer. The Associated Press called it a "government takeover," but this was no ordinary nationalization. Unlike the U.S. Treasury, which took over Fannie Mae and Freddie Mac the week before, the Fed is not a government-owned agency. Also unprecedented was the way the deal was funded. The Associated Press reported:

"The Treasury Department, for the first time in its history, said it would begin selling bonds for the Federal Reserve in an effort to help the central bank deal with its unprecedented borrowing needs."2

This is extraordinary. Why is the Treasury issuing U.S. government bonds (or debt) to fund the Fed, which is itself supposedly "the lender of last resort" created to fund the banks and the federal government? Yahoo Finance reported on September 17:

"The Treasury is setting up a temporary financing program at the Fed’s request. The program will auction Treasury bills to raise cash for the Fed’s use. The initiative aims to help the Fed manage its balance sheet following its efforts to enhance its liquidity facilities over the previous few quarters." ........more►

![]()

The Really Hard-to-Swallow Truth About the Bailout

We somehow came to believe Wall Street's success was ours too, and that the bills we owed were never going to come due. Well, they are now.

Myriad cultural historians have noted the American belief that success is a sign of God's favor. Over the past couple of decades, He has had a downright lovefest with the already-rich -- so much so that the richest 400 Americans now have more money stashed away than the combined bottom 150 million Americans. Some $1.6 trillion.......more►

![]()

![]() Betrayed by the Bailout: The Death of

Democracy

Betrayed by the Bailout: The Death of

Democracy

By William Cox

URL of this article: www.globalresearch.ca/index.php?context=va&aid=10433

Global Research, October 3, 2008

On this date, October 3, 2008, the American people were betrayed by those whom they had elected to represent them. The members of Congress who voted for the Wall Street "bailout" violated their oath of office to "support and defend the Constitution" ... "that I will bear true faith and allegiance to the same" ... "and that I will well and faithfully discharge the duties of the office on which I am about to enter: ..."

Without holding any meaningful hearings or public discussions and listening only to those most responsible for the economic disaster, Federal Reserve Board Chairman Ben Bernanke and Treasury Secretary Henry Paulson, Congress abdicated its responsibility to the American people........more►

![]()

Bailout Passes Senate; 9 Reasons That's Bad News for You

This country faces many serious problems in the financial market, in the stock market, in our economy. We must act, but we must act in a way that improves the situation. We can do better than the legislation now before Congress...........more►

![]()

|

“They Just Don’t Get It”—Political Leaders and Pundits

Are Clueless About Bailout Rejection

by Richard C. Cook

|

| Global Research, September 30, 2008 |

Stephen-Pearlstein is the Washington Post’s Pulitzer Prize-winning business columnist. In print and as a TV talking head—like on Chris Matthews’ Hardball late last week—Pearlstein is one of the foremost media cheerleaders for the $700 billion Wall Street bailout bill........ more►

![]()

There Might Be a Financial Crisis, But the World's Arms

Dealers Are Doing Just Fine

The CEO of a weapons manufacturer has plenty of chances to rub elbows with deputy secretaries of defense, officials from Homeland Security, retired military personnel, and the best and brightest of the defense establishment almost any week of the year.....more►

![]()

A Shattering Moment in America's Fall From Power

The global financial crisis will see the US falter in the same way the Soviet Union did when the Berlin Wall came down. The era of American dominance is over

![]()

The $700,000,000,000 Power Punch

Socializing Debt, Privatizing Profits and Power

Language from Section 8

Treasury Financial Bail-out Proposal

Breathtaking in its scope and staggering in its dollar amount, the Treasury Financial Bail-out Proposal to Congress is a parting power punch from the Bush Administration. Even as the American economy melts down, George W. Bush and his cronies are taking advantage of the emergency situation to turn over $700,000,000,000 of American tax payer's money to bail out the same greedy, corrupt corporations that got us into this mess; transfer most of the scant remaining congressional power into private hands and eviscerate judicial or administrative review of the process.

"The Secretary is authorized to take such actions as the Secretary deems necessary to carry out the authorities in this Act, including, without limitation," and so begins the Proposal that is perhaps the biggest peacetime (or anytime) transfers of power from Congress through the Administration to private corporations, in history........more►

![]()

|

Global Financial Meltdown

by Michel Chossudovsky

|

|

|

|

|

Global Research, September

18, 2008

|

|

|

|

|

Bloody Monday September 15, 2008

Bloody Monday, September 15, 2008. The Dow Jones industrial average (DJIA) declined by 504 points (4.4%), its largest drop since Sept. 17, 2001, when trading resumed after the 9/11 attacks.

The financial slide proceeded unabated, leading to an 800 point decline of the Dow Jones in less than a week. The World's stock markets are interconnected "around the clock" through instant computer link-up. Volatile trading on Wall Street immediately "spills over" into the European and Asian stock markets thereby rapidly permeating the entire financial system...........more►

![]()

If Jack Layton is to deliver on his

promise "to protect Canadians with new banking regulations" (Sept. 17, Welland,

ON), he’ll need to pay close attention to what has happened and what is now

happening at the Bank of Canada.

When I say the Bank of Canada, I mean

OUR bank – the people’s bank, the only publicly-owned central bank in North

America. Nationalized in 1938 by the government of the newly-elected prime

minister, William Lyon MacKenzie King, this bank has served Canada well. It

funded a war effort, a seaway, a trans-Canada highway, old age pensions, and

universal health care. All of that without serious inflation and all

interest-free, because any profits were paid into our national treasury.

![]()

Wag the Dog

How To Conceal Massive Economic Collapse

By Ellen Brown

“I’m

in show business, why come to me?”

“War is show business, that’s why we’re here.”

– “Wag the Dog” (1997 film)

16/08/08 "ICH" --- Last week, Fannie Mae and Freddie Mac had just announced record losses, and so had most reporting corporations. Unemployment was mounting, the foreclosure crisis was deepening, state budgets were in shambles, and massive bailouts were everywhere. Investors had every reason to expect the dollar and the stock market to plummet, and gold and oil to shoot up. Strangely, the Dow Jones Industrial Average gained 300 points, the dollar strengthened, and gold and oil were crushed. What happened? ........more►

![]()

![]() Subprime

Is Really SubCRIME: America's Deeper Financial Crisis

Subprime

Is Really SubCRIME: America's Deeper Financial Crisis

By Danny Schechter, AlterNet. Posted February 21, 2008.

Quoting Bank of America's chief market strategist, Joseph Quinlan, the crisis, which has spread beyond U.S. shores to banks and other sectors worldwide, is "one of the most vicious in financial history."

That number again: $7.7 TRILLION. That phrase again: "the most vicious," that is, worse than 1929 and all the financial crises since. more►

![]()

![]() Chomsky: Poorer Countries Find a Way to Escape U.S. Dominance

Chomsky: Poorer Countries Find a Way to Escape U.S. Dominance

The famous critic lays out the emerging alternatives to the U.S.-dominated international financial institutions of the last century.

Noam Chomsky is a noted linguist, author, and foreign policy expert. On January 15, Michael Shank interviewed him on the latest developments in U.S. policy toward regional challenges to U.S. power.

Michael Shank: In December 2007, seven South American countries officially launched the Bank of the South in response to growing opposition to the World Bank, the International Monetary Fund and other International Financial Institutions. How important is this shift and will it spur other responses in the developing world? Will it at some point completely undermine the reach of the World Bank and the IMF?... more►

![]() Dr. Michael Parenti: "Terrorism, Globalization, and Conspiracy"

Dr. Michael Parenti: "Terrorism, Globalization, and Conspiracy"

Globalization is an attempt to extend corporate monopoly

control over the whole globe - over every national economy, over every local

economy, over every life."

St. Andrews Wesley Church, Vancouver, October 9, 2002.►WATCH

THE LECTURE..

![]()

![]()

TRUE Government

The ten steps or stages to the evolution of a true democracy.

Slavery, serfdom, and all forms of human bondage must disappear.

Unless a free people are educated -- taught to think intelligently and plan wisely -- freedom usually does more harm than good.

Liberty can be enjoyed only when the will and whims of human rulers are replaced by legislative enactments in accordance with accepted fundamental law.

Representative government is unthinkable without freedom of all forms of expression for human aspirations and opinions.

No government can long endure if it fails to provide for the right to enjoy personal property in some form. Man craves the right to use, control, bestow, sell, lease, and bequeath his personal property.

Representative government assumes the right of citizens to be heard. The privilege of petition is inherent in free citizenship.

It is not enough to be heard; the power of petition must progress to the

actual management of the government.

Representative government presupposes an intelligent, efficient, and universal electorate. The character of such a government will ever be determined by the character and caliber of those who compose it. As civilization progresses, suffrage, while remaining universal for both sexes, will be effectively modified, regrouped, and otherwise differentiated.

9. Control of public servants.

No civil government will be serviceable and effective unless the citizenry possess and use wise techniques of guiding and controlling officeholders and public servants.

10. Intelligent and trained representation.

The survival of democracy is dependent on successful representative government; and that is conditioned upon the practice of electing to public offices only those individuals who are technically trained, intellectually competent, socially loyal, and morally fit. Only by such provisions can government of the people, by the people, and for the people be preserved.